2024 Contributions. Traditional ira contributions may be tax. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

These rates are applicable and accurate for. The maximum annual contribution for 2023 is $6,500, or $7,500 if you’re age 50 or older, and you can make those contributions through april of.

Super Contributions To Defined Benefit And Constitutionally Protected Funds.

For 2023, taxpayers began making contributions toward that tax year’s limit as of jan.

The Limit On Charitable Cash Contributions Is 60% Of The Taxpayer's Adjusted Gross Income For Tax Years 2023 And 2024.

This deadline expires when 2023 taxes are due on april.

The Maximum Annual Contribution For 2023 Is $6,500, Or $7,500 If You're Age 50 Or Older, And You Can Make Those Contributions Through April Of.

Images References :

Source: mufiqjoelynn.pages.dev

Source: mufiqjoelynn.pages.dev

Discover Product Change 2024 Shel Gabriela, The 2024 403 (b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. A tool for employers and employees to calculate their cpf contributions.

Source: www.howtoquick.net

Source: www.howtoquick.net

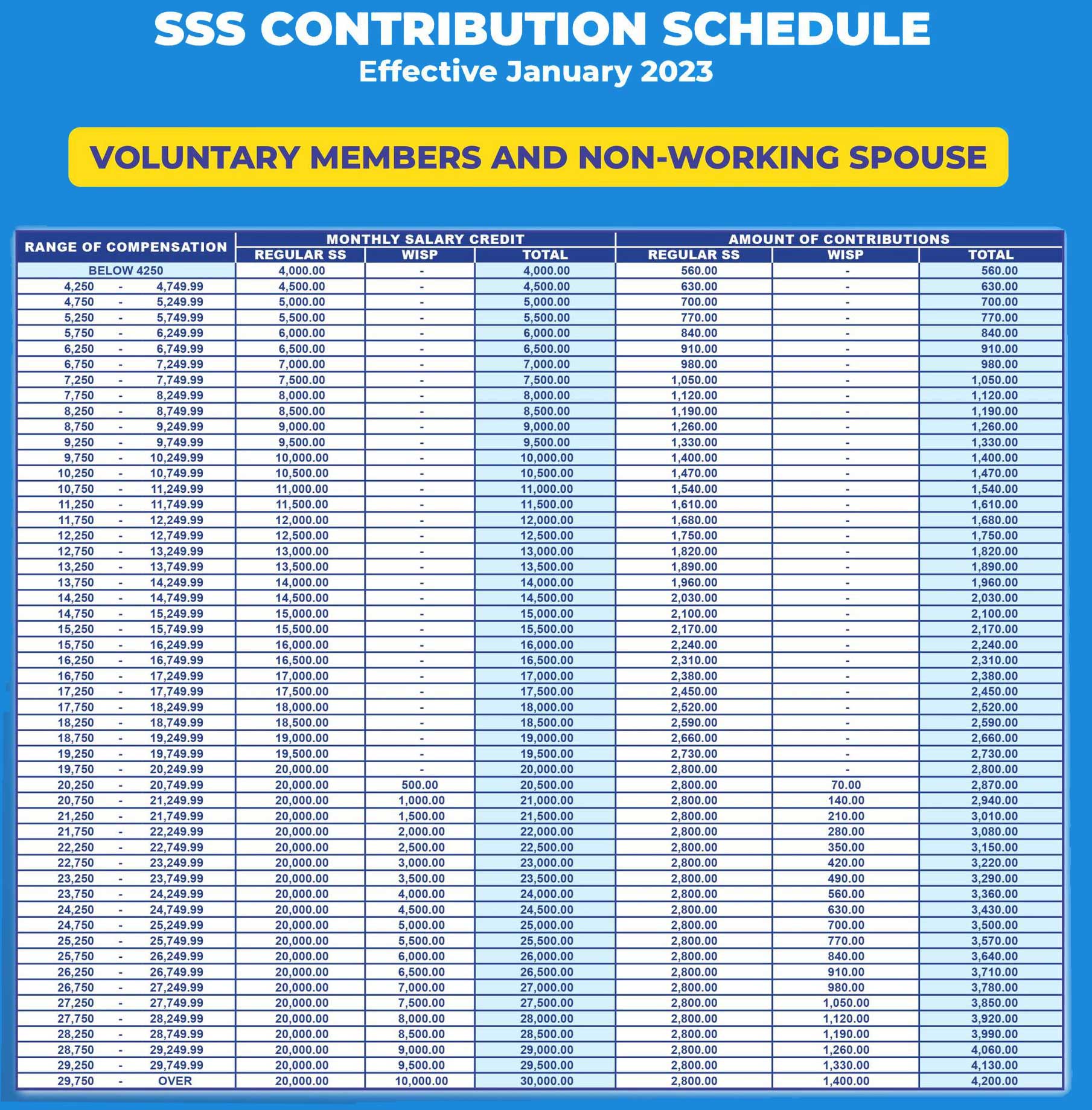

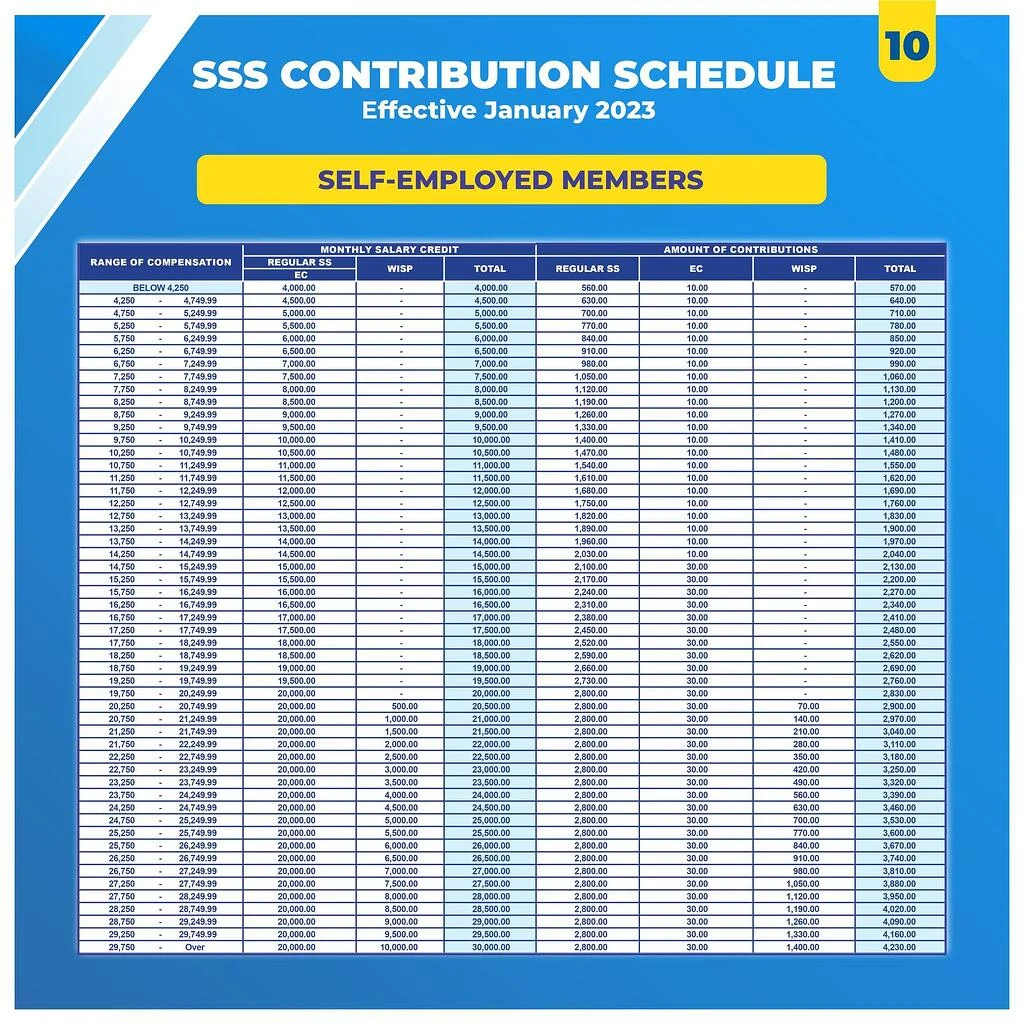

SSS Voluntary Members Contribution Table 2024, A tool for employers and employees to calculate their cpf contributions. For 2023, taxpayers began making contributions toward that tax year’s limit as of jan.

Source: www.daberistic.com

Source: www.daberistic.com

Investments and Life Insurance News Daberistic, All you need to know about the latest cpf contributions rates for 2024 & cpf contribution cap. The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023.

Source: announcement.ph

Source: announcement.ph

How to Apply for SSS's Worker’s Investment and Savings Program and WISP, Posted on 16 march 2023. Salary caps, contribution rates and.

Source: www.blogrojak.com

Source: www.blogrojak.com

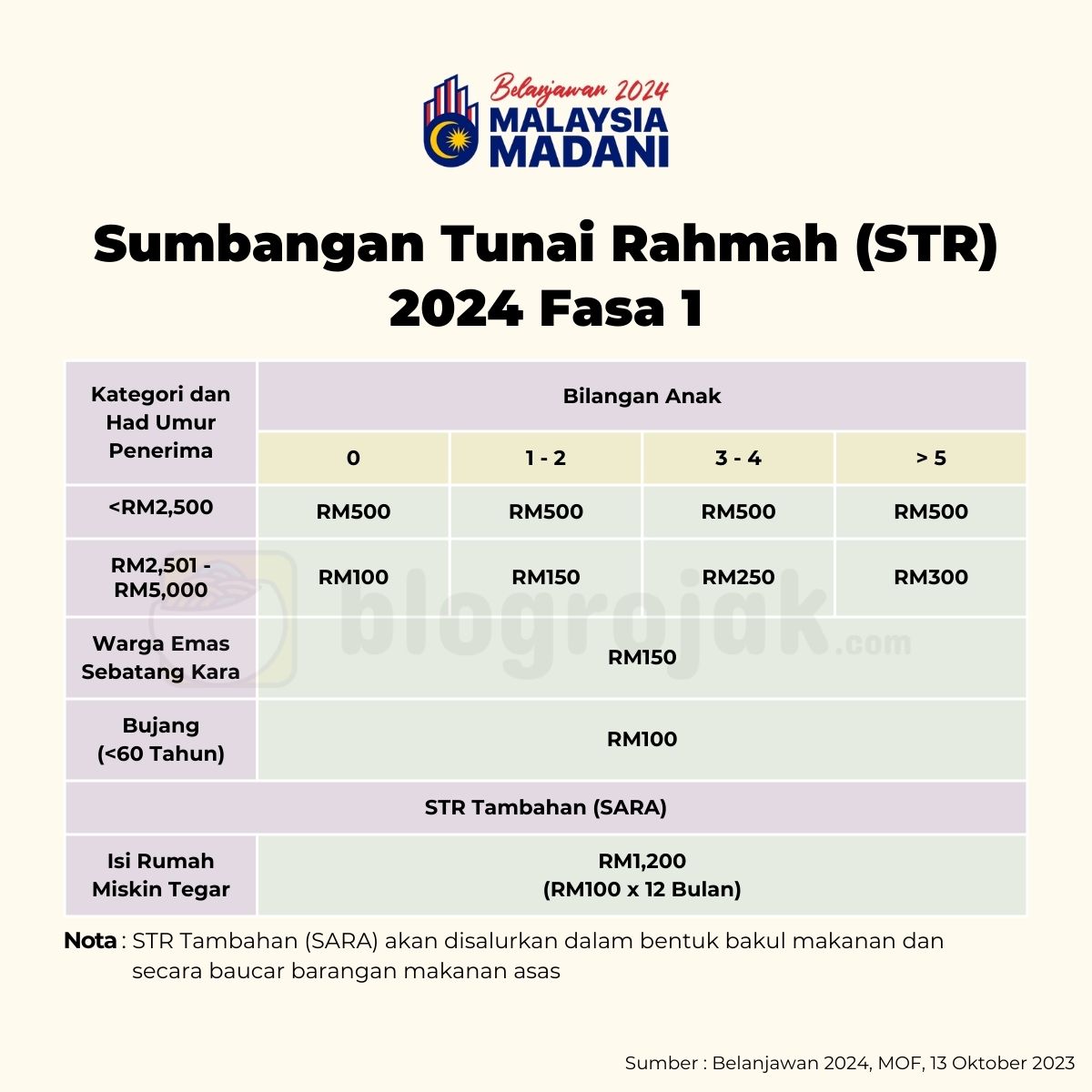

STR 2024 Semakan Status & Pembayaran Bermula Februari, The maximum annual contribution for 2023 is $6,500, or $7,500 if you're age 50 or older, and you can make those contributions through april of. Traditional ira contributions may be tax.

Source: www.portalmykerja.com

Source: www.portalmykerja.com

STR 2024 Jumlah Bayaran STR Fasa 1 Mengikut Kategori My Kerja!, The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer. These rates are applicable and accurate for.

Source: www.mingguankerja.my

Source: www.mingguankerja.my

STR 2024 Tarikh Permohonan & Pembayaran Sumbangan Tunai Rahmah Fasa 1, The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older. Find out about caps on contributions to defined benefit funds and constitutionally protected.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Tfsa contribution room at the beginning of 2024; The maximum annual traditional ira contribution limit is $7,000 in 2024 ($8,000 if age 50 or older).

Source: www.daberistic.com

Source: www.daberistic.com

Discovery Medical Aid Premium Update 2023 Daberistic, Traditional ira contributions may be tax. For 2023, taxpayers began making contributions toward that tax year’s limit as of jan.

Source: presse.opcomobilites.fr

Source: presse.opcomobilites.fr

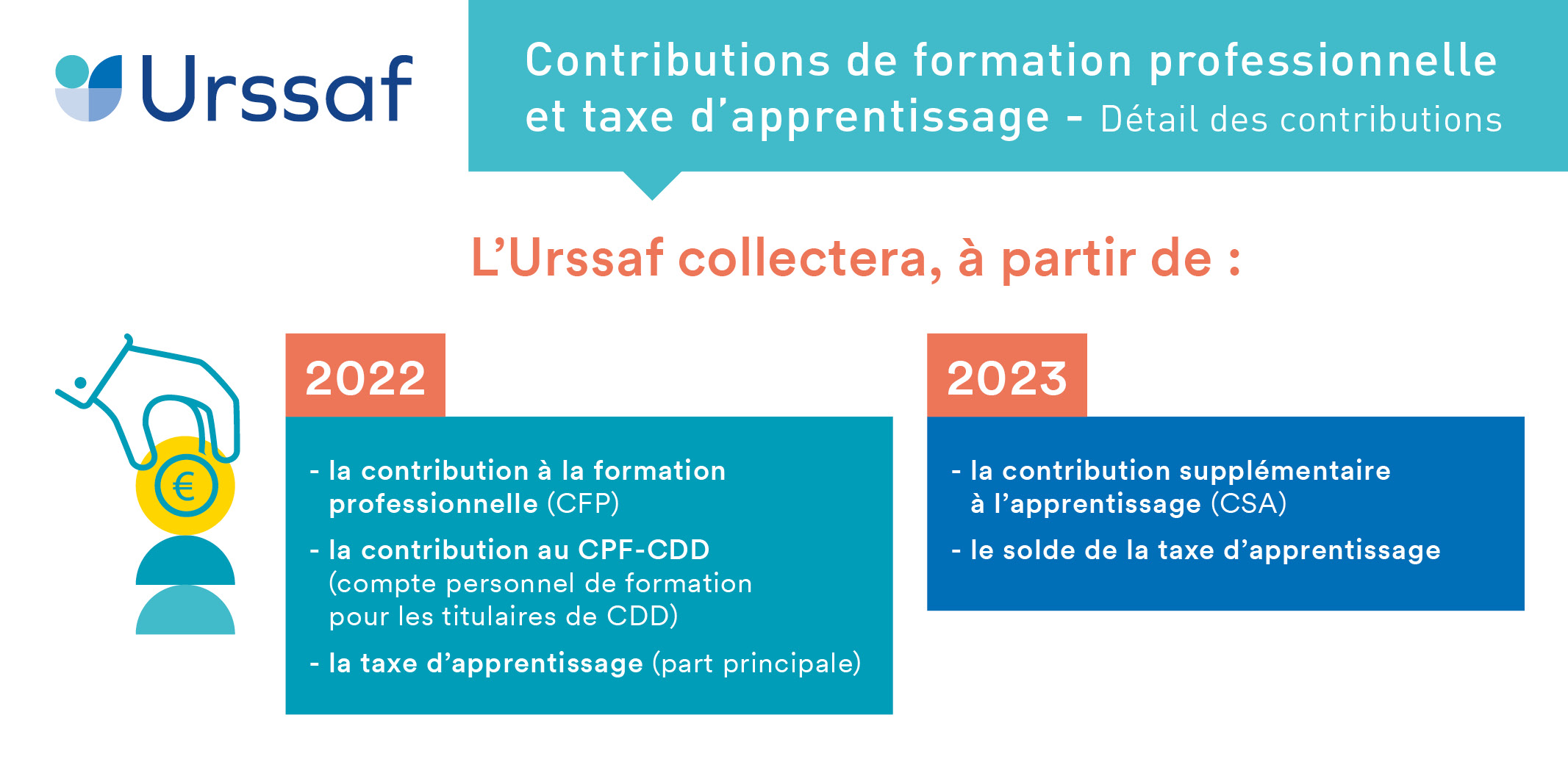

Contributions les évolutions en 2022 OPCO Mobilités Espace Presse, So for 2024, you could start making contributions on jan. Salary caps, contribution rates and.

Salary Caps, Contribution Rates And.

The 401(k) contribution limit for 2024 is $23,000 for employee contributions, and $69,000 for the combined employee and employer.

This Deadline Expires When 2023 Taxes Are Due On April.

All you need to know about the latest cpf contributions rates for 2024 & cpf contribution cap.